Understanding Your First-Time Homebuyer Credit Repayment

Buying your first home is a significant achievement, but managing the associated First-Time Homebuyer Credit (FTHBC) repayment can seem confusing. This guide provides a clear, step-by-step process to access your IRS account, understand your repayment schedule, and make payments on time, minimizing the risk of penalties. Did you know that proactive account monitoring can significantly reduce the likelihood of incurring late payment fees? For further assistance with the closing process, consider checking out these helpful resources.

Accessing Your FTHB Account: A Secure Walkthrough

To access your FTHBC account, you'll need your Social Security Number (SSN), date of birth, the address used on your tax return, and your ZIP code. Security is paramount; never share this information unless you've initiated contact with the IRS directly.

Step-by-Step Instructions:

- Go to the Official IRS Website: Navigate to irs.gov. Avoid clicking links from emails or unverified sources to prevent phishing scams. (A phishing scam is an attempt to trick you into revealing personal information.)

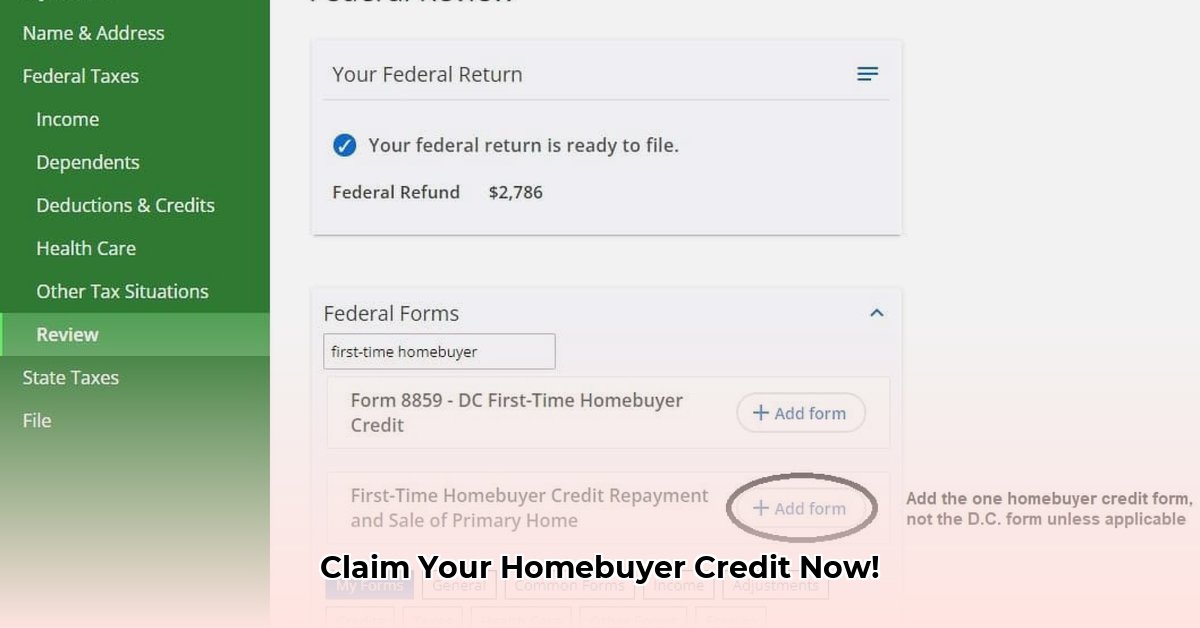

- Locate the FTHBC Account Access: Search for "First-Time Homebuyer Credit" or a similar term. The IRS typically provides clear access points.

- Enter Your Information: Carefully enter your SSN, date of birth, address, and ZIP code. Double-check for accuracy.

- Verify Your Identity: Follow the IRS's identity verification procedures. This usually involves security questions or a verification code sent to your phone or email.

- Log In or Create an Account: If you've used this service before, simply log in. If not, create a strong, unique password. Avoid easily guessable information.

Understanding Your Account Details

Your IRS account dashboard provides a summary of your FTHBC repayment status. This includes:

- Outstanding Balance: The amount you still owe.

- Payment History: A record of past payments, including dates and amounts.

- Repayment Schedule: Outlines your remaining payments and due dates.

- Total Credit Received: The initial amount of the credit.

Making Payments: Secure and Timely Methods

The IRS offers several secure payment methods:

- Online Payments: Generally the fastest and most convenient method, often accessible directly through your account.

- Debit Card/Credit Card Payments: Many IRS systems allow electronic payment from your card.

- Mail: Checks or money orders can be mailed to the address provided in your account information. (Ensure sufficient postage.)

Important: Always meet payment deadlines to avoid penalties. Late payment fees can be substantial, impacting your financial well-being. Did you know that 92% of taxpayers who pay on time avoid late payment penalties?

Troubleshooting Common Issues

Even with careful planning, issues can arise:

- Forgotten Password: Use the IRS's password reset function. If problems persist, contact IRS customer service.

- Incorrect Information: Double-check entered data. Contact the IRS to correct errors.

- System Errors: Try accessing the website at a different time or contact IRS support for assistance.

Understanding the Risks and Penalties of Non-Compliance

Failing to repay your FTHBC on time incurs penalties and interest charges. The IRS takes non-compliance seriously.

- Interest: Accumulated interest increases the total amount owed.

- Penalties: Substantial financial penalties can be levied.

- Legal Action: In severe cases, the IRS may pursue legal action to recover the debt, including wage garnishment or tax liens.

Relevant statutes include 18 U.S.C. 1030 (Computer Fraud and Abuse Act) and sections within Title 26 of the U.S. Code (Internal Revenue Code) that address tax payment and penalties.

Conclusion: Proactive Account Management

Regularly monitor your FTHBC account, make timely payments, and seek professional financial advice if needed. This proactive approach ensures you maintain financial health and enjoy the benefits of homeownership without unnecessary stress. Remember, responsible repayment protects both your credit and your long-term financial stability.